Weathering the downturn

Natural selection—and optimism— on display

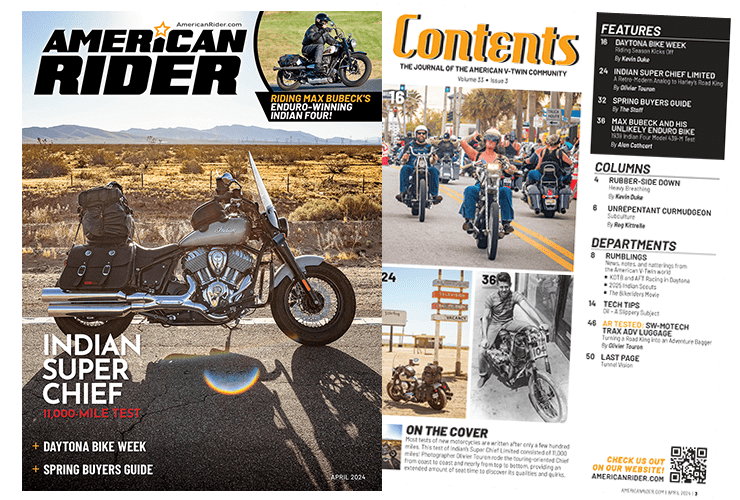

Cincinnati, Ohio, Feb. 7–9—Much as Daytona Bike Week is the harbinger of spring for hundreds of thousands of riders, the V-Twin Expo portends the start of the new product year for motorcycle parts manufacturers and distributors. And if the unusually spring-like 50-degree weather in the normally frigid month of February in Cincinnati was any indication of the upcoming year, the future looked bright indeed.

Now in its ninth year, the V-Twin Expo continues to be the principal American motorcycle aftermarket trade show. It’s the place to see and be seen for those in the motorcycle industry, and business deals are struck not only on the show floor but also at the numerous industry parties held after Expo hours.

Four years ago, while the industry was booming along, the event outgrew the first floor of the massive Duke Energy Center, spilling out into the lobby. Many more exhibit booths—in addition to the new products showcase—took up residence on the third floor. This arrangement continued through last year when over 500 exhibitors took up more than 1,000 booths. This year, however, all exhibits were situated on the first floor. Jim Betlach, V-Twin Expo executive producer explained, “We had a 25 percent decrease in exhibitors, and only a very slight decrease in attendees. We were very pleasantly surprised at how good the turnout was; in fact, it took 15 minutes for everyone to get inside when the doors opened on Saturday. The exhibitors were as busy, if not more busy, than at any show we’ve ever done.” In years past, many shop owners would bring along their staffs as a job perq; however, those days are behind us. Everyone was at the show to do business, and it was clear that attendees were serious about buying.

One visible upshot of the economic downturn in the industry was what you might call Moto-Darwinism—the notion that adversity thins the herd. Backing up that theory, John Hoppe, founder of Hoppe Industries and winner of the V-Twin Expo Innovative Product of the Year for his Quadzilla fairing, stated, “I think the year 2009 will weed out those that were only in it for the fast bucks. A lot of the problems with those new to the circuit will stem from buying into big rigs and splashy promotions and overextending themselves.”

And sure enough, missing from the show were a good many of the ultra-high-dollar custom machines, whimsical blinged-out parts, and the cheap, low-quality frames, wheels, motors and transmissions that flooded the show floor in years past. Instead, dealers and motorcycle shop owners were treated to an array of reasonably-priced production bikes and practical and proven parts and accessories.

Seminars serve up solutions

An encouraging by-product of the recession is the effort being made to attract two fast-growing segments of the riding demographic—women and youth—who, in turn, become parts, accessories and apparel consumers. Well-attended seminars like “Untapped Markets: Selling to Women” and the brand-new “Next Generation Marketing” where branding, imagery, customer communication, technology, connecting with younger riders, and drawing on inspiration from the past were discussed.

Keith Ball, founder of Bikernet.com, emceed a standing-room-only meeting to discuss the formation of a Motorcycle Aftermarket Action Council under the Specialty Equipment Market Association (SEMA), an organization that supports the automotive aftermarket. The intent of the Motorcycle Aftermarket Action Council is to support the freedom to build and ride custom motorcycles and to create an active link between the motorcycle aftermarket industry and the motorcycle rights community. Representatives of the Motorcycle Rider Foundation, the Motorcycle Industry Council, and SEMA joined Keith on the panel and voiced their views. Most attendees seemed positive about forming such a council, agreeing that a unified voice could be beneficial to the future of motorcycling.

Other seminars ranging from tech tutorials covering fuel injection and high performance to business sessions covering topics such as making shops more profitable, combating counterfeiting and knock-offs, dealer insurance and motorcycle shop software were presented. Metzeler sponsored a well-attended roundtable breakfast aptly titled, “Hey, who turned the lights out?” Industry experts commented on current economic realities including lower sales on high-dollar parts and the extreme drop in custom bike orders. However, it was pointed out that bikes under $10,000 and add-on parts costing between $50 and $200 are still selling, and many builders are now earning a living modifying stock bikes rather than fabricating new ones.

The year of the makeover

We spent considerable time talking with people who make their living in the motorcycle world. Not surprisingly, parts manufacturers and independent motorcycle shops have been focusing on riders who are keeping their bikes longer, as new motorcycle sales have dipped in the past year. What we didn’t expect was how well some companies did in 2008. Nick Trumbo from Bassani Exhaust commented, “Our business has been really good. We’re up almost double digits over last year.”

Brian Klock told me, “It was a pretty phenomenal year of growth for the entire KlockWerks crew. It’s almost embarrassing to say we’ve grown 650 percent last year in what people are terming a down market. This year, you’re not going to see as many high-dollar high-end bike builds, but you will see more makeovers. The guy who already has a Sportster or a Softail or a bagger wants to change a little something. He may not have $40,000 or $50,000 to buy a new bike, but he has a couple of hundred dollars for parts, so shops will see sales of $500 or under. The key, though, is the shop’s customer service and keeping that high level of quality. I think it’s going to be the year of the makeover. It’s good for the aftermarket.”

The several-hundred-dollar-sale theme was quite evident throughout the show, demonstrated by sales tools like the mini-brochure I saw at T-Bags’ booth touting “8 New T-Bags Under $100 Retail.” And sellers are carrying this mindset into their stores and their web sites. At the top of the category browsing selections on its home page, parts distributor MC Advantages has a set of links organized by dollar amount—$50 or less, $100 or less, and $200 or less.

Many companies that sell high-dollar products have dropped their prices considerably. OCC Motorcycles now offers its low-end model, the Greenie, for $27,995, a substantial drop from its base $31,900 price tag when first introduced in 2007. To accomplish this, the company introduced less costly (but, according to OCC, still high-quality) components into the newer models. And accessories manufacturers like Cycle Sounds have introduced discounts to their new line of motorcycle sound system products to fall more in line with today’s economy.

Widening horizons

The tradeshow floor reflected some of the topics discussed in the weekend’s seminars, specifically those reaching out to new audiences. Probably the most dynamic first-time exhibit was Limpnickie Lot, a booth that contained several custom bikes and parts set against the backdrop of a specially built miniature skateboard half-pipe. This group of next-generation builders burst upon the scene two years ago at a skate park in Daytona, and then in Sturgis, where they could display their custom bikes and parts, host ride-in bike shows, and provide entertainment like live music, thrill shows, skateboarding and paintball competitions. The endeavor has evolved into a cooperative effort resulting in the new Limpnickie Lot Builder Manual, a 68-page catalog promoting each builder’s parts and services.

Many companies are casting their nets outside of the motorcycle world in an attempt to maintain or grow their businesses. WileyX, one of the best known manufacturers of riding glasses for motorcyclists, actually started their business by supplying eyewear to the military. Rob Maser, WileyX commercial sales manager, said, “Although we have a new product release every two years, and the next one will not be until 2010, we can’t stand still until then. We are constantly adjusting to what works and what doesn’t. We are not shrinking because we know we can support our product. We hope to grow 50 percent in 2009 mainly due to our excellent pricing and our superior product.”

Dan Parks, proprietor of Cruz Tools, comments, “Fortunately, our business is more on the maintenance side of things. Since fewer people are buying new bikes, they’re hanging onto their current bikes and doing a little more maintenance along with some upgrades, so that bodes well for our side of the business. We also took a complete left turn and introduced a line of musician’s tools, so obviously it’s a completely new market, but the prospects are very good and we got off to a good start.”

Same time next year

Of course, everyone wonders what the industry will look like as the year proceeds, and Dan says, “I don’t think things are really going to get any worse. My opinion is that what we’re experiencing now is more of a crisis of confidence than anything else.” Dan continues, “We’re going to dawdle along at the same kind of lethargic business environment for the next six months or so. I wouldn’t be surprised if, by this time next year, we start to see an overheated recovery. I think the economy will swing dramatically in the other direction, and that could present its own set of problems. As everybody takes that pent-up demand and starts spending again, we may find the problems associated with an overheated economy, like material shortages and inflation.”

And what will we see regarding all the rallies that have sprung up in the past decade? Joe Biggs, promoter of the Thunder Beach Motorcycle Rally in Panama City Beach, Florida, comments, “Our 2008 fall rally was down by maybe 15 percent. Our spring event in 2008 about the same attendance as the 2007 rally, and it was the first time we had no appreciable increase in attendance since we started… I think there will be a thinning of the herd as far as rallies go, although it may take a year or so. The strong will survive—both rallies and the industry as a whole.”